What are stablecoins?

How to create a stablecoin?

What is the point of everyone having their own stablecoin?

Why are stablecoins useful?

Which stablecoin is the best?

These are some common Stablecoin-related queries that have been flooding Reddit, Quora, and other forums. However, you may be thinking, “can someone explain these to me like I’m a 5-year-old baby?” Yes, we will. We’ll break it down in the most straightforward answers.

A stablecoin is a cryptocurrency designed to keep a steady value tied to a specific asset or a group of assets. It offers the innovation of blockchain with the reliability of fiat currencies like the U.S. dollar or gold. This stablecoin development guide will walk you through the fundamentals, architecture, and practical steps to design, build, and deploy a stablecoin in 2026.

What is a Stablecoin?

A stablecoin is a cryptocurrency designed to maintain a consistent value by pegging its price to a stable asset such as the U.S. dollar, euro, or gold. Unlike volatile cryptocurrencies like Bitcoin, stablecoins provide price stability while preserving the core advantages of blockchain technology: transparency, security, and speed.

These digital assets achieve stability through collateralization, where reserves of fiat currency, commodities, or other cryptocurrencies back each token. This process is essential if you want to create a stablecoin. This ensures predictable value, making stablecoins ideal for global payments, trading, and decentralized finance (DeFi) applications.

For enterprises looking to build trusted digital financial solutions, learning how to create your own stablecoin can unlock opportunities in payments, lending, and cross-border transactions.

Partnering with an experienced fintech app development company can simplify the process, helping you design, develop, and deploy a secure, compliant, and scalable stablecoin ecosystem tailored to your business goals.

What’s the Difference Between Stablecoin and Traditional Currency?

The key difference between stablecoin vs. traditional currency is control. A central bank issues traditional currency, while stablecoins are digital assets on a blockchain, pegged to stable assets like the US dollar to maintain value.

Let’s find out more about it in the comparison table below:

| Parameter | Stablecoins | Traditional Currencies |

|---|---|---|

| Control | Decentralized or semi-decentralized through blockchain | Controlled by central banks and governments |

| Transaction Speed | Minutes or seconds, 24/7 availability | Hours to days for international transfers, limited banking hours |

| Transaction Costs | Lower fees, especially for cross-border payments | Higher fees for international transfers and currency conversion |

| Transparency | All transactions are visible on the blockchain | Limited transparency, depends on banking systems |

| Accessibility | Anyone with internet can access | Requires a bank account and documentation |

| Regulation | Evolving frameworks vary by country | Well-established regulatory systems |

| Technology | Runs on blockchain with smart contracts | Traditional banking infrastructure |

| Programmability | Can be integrated with smart contracts and DeFi protocols | Limited programmability, manual processes |

| Cross-Border Payments | Instant settlement across borders | Slow, expensive, multiple intermediaries |

| Volatility | Stable value pegged to assets | Stable but subject to inflation |

What are the Different Types of Stablecoins?

As stablecoins continue to redefine the global digital economy, understanding their categories is essential for anyone exploring blockchain-powered financial solutions.

Each type follows a unique mechanism to preserve price stability, combining blockchain’s transparency with the dependability of traditional monetary systems.

Let’s explore the major types of stablecoins and how each functions, as it will help you to know how to create a stablecoin for that particular type or category.

1. Collateralized Stablecoins

Collateralized stablecoins are backed by tangible or digital assets that ensure their value remains stable. They are the most common category, supported by reserves that can be audited or verified.

Collateralized stablecoins are further divided into three subtypes:

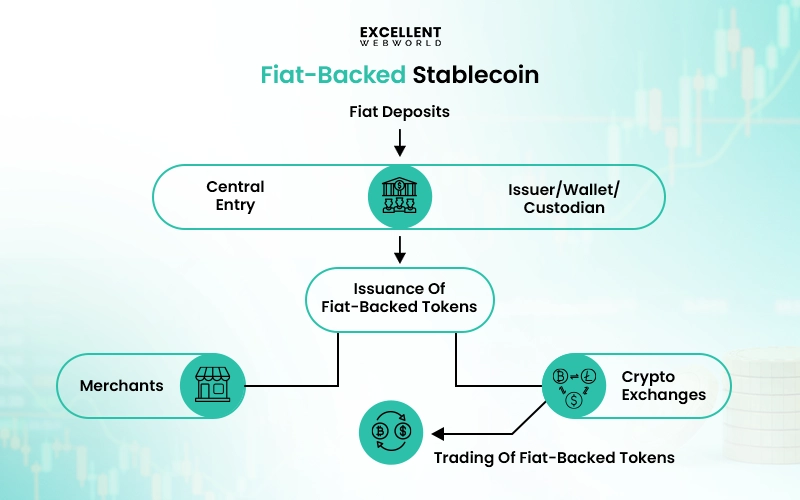

(a) Fiat-Backed Stablecoins

These are pegged to government-issued currencies such as the U.S. Dollar, the Euro, or the Pound. Each stablecoin represents an equivalent amount of fiat currency held in reserve by a custodian, maintaining a 1:1 ratio.

This transparency and reliability make fiat-backed stablecoins ideal for remittances, payments, and exchange transfers. Popular examples include Tether (USDT), USD Coin (USDC), and PAXOS Standard (PAX).

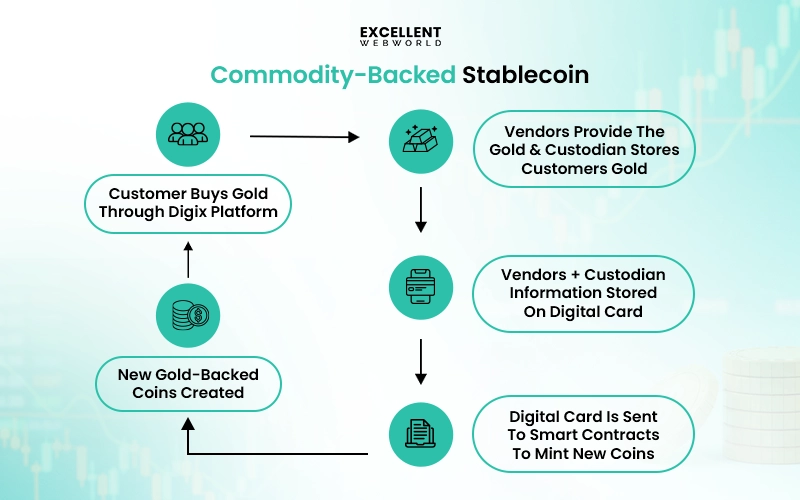

(b) Commodity-Backed Stablecoins

Commodity-backed stablecoins derive their value from physical assets such as gold, silver, or oil. These tokens appeal to investors who want blockchain-based exposure to real-world commodities while maintaining stability. For instance, Tether Gold (XAUT) and PAX Gold (PAXG) represent ownership in actual gold reserves stored securely by trusted custodians.

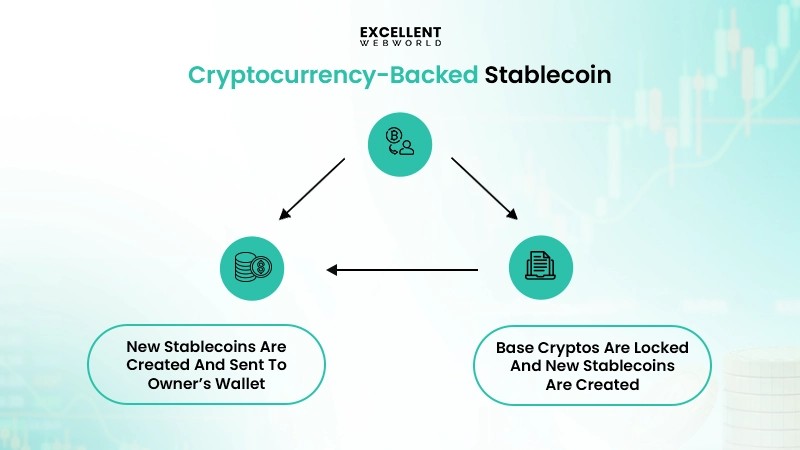

(c) Cryptocurrency-Backed Stablecoins

Other cryptocurrencies collateralize this subtype. Because crypto assets are volatile, over-collateralization is used to maintain stability. The DAI token, for example, is backed by Ether (ETH) and governed through MakerDAO’s smart contracts, which adjust token supply to preserve its peg to the U.S. dollar.

2. Non-Collateralized Stablecoins

Also known as seigniorage or elastic supply stablecoins, these do not rely on any physical or digital collateral. Instead, they maintain price stability through algorithmic mechanisms that expand or contract supply based on market demand.

This decentralized approach eliminates dependence on centralized reserves or intermediaries. A notable example was Basis, which automatically managed supply to maintain a stable price.

3. Programmable/Algorithmic Stablecoins

Programmable or algorithmic stablecoins use smart contracts and preset algorithms to regulate their circulation and maintain stability. When demand rises, new tokens are created; when demand drops, tokens are removed from circulation.

This system mimics how central banks manage monetary policy but operates transparently through code. This is an algorithmic approach that will help you create a stablecoin. Some algorithmic models also maintain partial reserves to enhance reliability.

Each type of stablecoin serves a different purpose, from enabling digital commerce to powering decentralized finance ecosystems. Suppose you’re an entrepreneur and blockchain innovator. In that case, understanding these models is a crucial step before deciding to create your own cryptocurrency website.

What are the Key Advantages of Creating a Stablecoin?

The difference between digital assets and traditional finance is evident. By fusing the stability of money with the efficiency of blockchain, Stablecoin seeks to address that gap. That’s why it has become a go-to choice for fintech companies that wish to follow the latest fintech trends.

Here is the list of advantages that you will get by creating a stablecoin:

1. Reduced Market Volatility

A low-risk substitute for unstable cryptocurrencies is provided by stablecoins. They assist investors in safeguarding earnings and reducing their exposure to unpredictable price fluctuations by keeping a 1:1 peg with fiat currencies or assets.

2. Seamless Fiat-to-Crypto Conversion

Investors frequently convert funds into stablecoins such as USDT or USDC before entering the cryptocurrency market. This facilitates platforms integrating payments, one of the several fintech API use cases, for increased efficiency and makes onboarding new customers easier.

3. Reliable Medium for Blockchain Transactions

Stablecoins are now the most reliable way to move money between blockchain networks. They are perfect for high-frequency trading, decentralized apps (dApps), and cross-border payments due to their price stability.

4. Enhanced Cross-Border Payment Efficiency

Stablecoins enable almost instantaneous international money transfers at low cost by eliminating middlemen. This use case is fueling adoption, mainly as companies invest in mobile app development for digital banking and e-commerce to enable cross-border payments.

5. Supports Institutional and Enterprise Adoption

Businesses may incorporate blockchain technology into their financial systems without being exposed to cryptocurrency volatility thanks to stablecoins. They make digital transactions in a variety of business sectors transparent, auditable, and compliant.

6. Empowering Financial Inclusion

Stablecoins serve as a safe store of value in areas with erratic currencies or restricted banking access. They enable people and small enterprises to conduct business with confidence by providing worldwide accessibility.

What are the Use Cases of Stablecoins?

You should be aware of the following use cases while creating a stablecoin:

1. Minimize Volatility

Stablecoin has a consistent value, which you may not find in other cryptocurrencies like Bitcoin or Ether, which change due the market fluctuations.

They are ideal for regular transactions and digital trade because of their stability, which mirrors the most current stablecoin development traits in economic ecosystems.

2. Trade or Save Assets

Stablecoins allow users to safely save and switch digital assets without relying on traditional banks. They provide a dependable and safe manner to exchange or build wealth, which is useful in international locations where strong fiat currencies are scarce.

3. Earn Interest

By depositing stablecoins into lending systems or DeFi protocols, customers can generate higher returns than they might with traditional banks. This use case illustrates how solid virtual assets can beautify user engagement in decentralized finance.

4. Transfer Money Cheaply

Traditional move-border transfers are frequently steeply-priced and slow. Because stablecoins permit reasonably-priced, almost instantaneous transactions, they’re perfect for groups seeking to build a fintech app that allows global payments and seamless digital wallets.

How to Create a Stablecoin? Decoding the Steps to Build a Stablecoin

The stablecoin development process calls for cautious planning across legal, technical, and financial dimensions. Here are the eight steps that will help you create a stablecoin that is compliant and competitive in 2026.

Step 1: Identify the Type of Stablecoin to be Developed

The foundation of how to create a stablecoin lies in defining the mechanism that retains its price stability.

Broadly, there are two categories: collateralized and non-collateralized (algorithmic) stablecoins.

Ask strategic questions before choosing the model:

The answers will define your technical direction and governance framework for the project.

Step 2: Focus on Regulatory Compliance and Licensing

Compliance is a cornerstone of stablecoin success. With evolving financial regulations worldwide, aligning with KYC (Know Your Customer), AML (Anti-Money Laundering), and reserve transparency rules ensures credibility and user trust.

Best practices to follow:

By making compliance a built-in feature rather than an afterthought, your stablecoin becomes enterprise-grade and trustworthy from day one.

Step 3: Decide on the Blockchain Platform and Technologies

Selecting the right blockchain platform defines how scalable and efficient your stablecoin will be. While Ethereum has been the traditional choice, newer platforms such as Binance Smart Chain (BSC), Tron, and EOS offer competitive advantages in speed, scalability, and cost efficiency.

Platform selection checklist:

Technology considerations:

A well-chosen platform ensures your stablecoin can handle growth, maintain interoperability, and deliver smooth user experiences.

Step 4: Think About Liquidity Maintenance

Liquidity is what keeps a stablecoin’s ecosystem alive. Without it, even the most technically advanced projects can fail to maintain value stability.

Here are the liquidity management essentials you should keep in mind while creating a stablecoin:

These practices not only ensure financial stability but also attract users and investors who value transparency and consistent value.

Prefer a visual guide instead of reading these steps?

Watch our step-by-step video tutorial that walks you through the entire stablecoin development process, from choosing the right model to launching on mainnet.

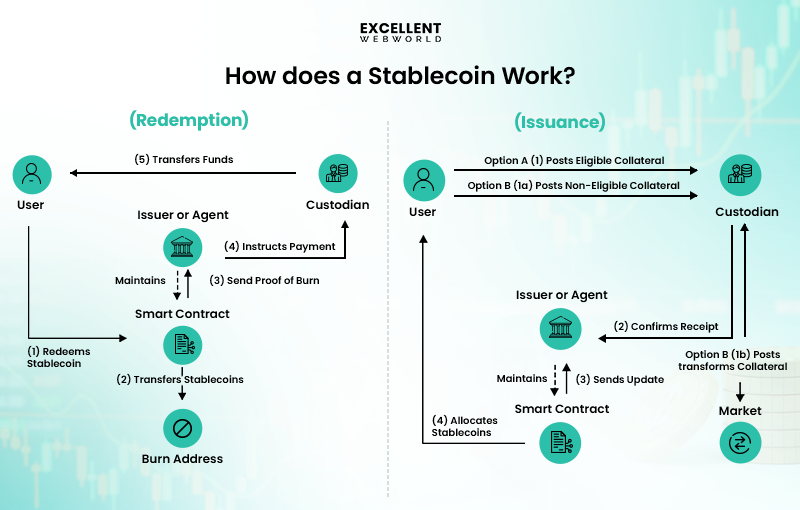

Step 5: Create a Smart Contract

Smart contracts are the programmable backbone of your stablecoin, enabling automated, trustless transactions. They define rules for issuance, redemption, collateral locking, and supply adjustment.

Development steps:

A firm smart contract ensures stability, transparency, and user confidence while minimizing operational risks.

Step 6: Create Technical and Visual Design for the System

Your stablecoin ecosystem needs an intuitive user experience and robust technical infrastructure. Beyond blockchain logic, this phase involves designing interfaces for both backend operations and end-user interactions.

Design process includes:

An elegant and functional design will enhance adoption and make your stablecoin more appealing to mainstream users.

Step 7: Development and Integration of Blockchain Platform

After designs and smart contracts are finalized, it’s time to build and integrate the blockchain platform components.

Core integration steps:

To expand utility, many enterprises integrate their stablecoin into broader ecosystems. For instance, using it as a payment method when they create an NFT marketplace.

This not only provides transaction stability for NFT trades but also broadens token adoption across Web3 ecosystems.

Step 8: Launch the Stablecoin to Mainnet

The final stage involves deploying the stablecoin on the mainnet, making it live for global transactions. This phase demands precision, as it transitions your project from testing to real-world usage.

Launch checklist:

Launching successfully positions your stablecoin as a trusted financial instrument capable of driving innovation across fintech, DeFi, and global payments.

What are the Key Challenges in Creating a Stablecoin?

Developing a stablecoin in today’s fast-evolving digital finance landscape demands precision, security, and transparency.

While stablecoins promise seamless cross-border transactions and decentralized value transfer, building one that is sustainable and trusted presents multiple challenges.

1. Regulatory Compliance

One of the toughest challenges for any stablecoin development company is navigating global regulations. Meeting KYC/AML requirements, securing licenses, and adhering to jurisdiction-specific rules are essential to avoid legal risks and ensure operational legitimacy.

2. Maintaining the Peg

A stablecoin’s success depends on how well it maintains parity with its underlying asset. Poor reserve management, market volatility, or algorithmic flaws can disrupt the peg, leading to financial instability and loss of trust.

3. Security Risks

Smart contract vulnerabilities and cyber threats can expose user funds to theft or manipulation. Regular audits, multi-layer encryption, and continuous monitoring are necessary to maintain security and safeguard user assets.

4. Liquidity and Adoption

Even a well-designed stablecoin can fail without widespread adoption. Entrepreneurs looking to start a fintech company must focus on exchange listings, merchant integrations, and community engagement to drive real-world usability.

5. Transparency and Trust

Users and regulators expect complete clarity regarding reserves and governance. Public audit reports and transparent operations are crucial for maintaining credibility in an increasingly regulated market.

6. Technological Scalability

As user bases expand, the blockchain must handle large transaction volumes efficiently. AI in fintech is the key integration point that can enhance transaction speed, fraud detection, and predictive analytics to support this scalability effectively.

Why Choose Excellent Webworld for Stablecoin Development?

Choosing the right partner for stablecoin development can define your success in this rapidly evolving market.

At Excellent Webworld, we combine deep expertise in blockchain, AI, and cloud technologies to help enterprises build compliant, secure, and scalable stablecoins.

Our experience across multiple jurisdictions ensures regulatory confidence, liquidity stability, and end-to-end data protection.

From smart contract audits to long-term governance models, we manage the technical and compliance challenges so your team can focus on innovation and market growth.

Ready to bring your stablecoin vision to life? Schedule a personalized consultation today and get a tailored roadmap to accelerate your launch.

FAQs About Stablecoin Development

Stablecoin development involves creating a digital currency designed to maintain a stable value by being tied to assets like the US dollar or gold, unlike regular cryptocurrencies, which can experience wild price swings.

The four types are: fiat-backed (pegged to USD/EUR), crypto-backed (backed by other cryptocurrencies), commodity-backed (tied to gold/oil), and algorithmic (controlled by code).

Stablecoins are created by writing smart contracts on blockchain platforms, establishing what backs the coin’s value (reserves or algorithms), and setting up systems to maintain the stable price peg.

Yes, but you’ll need blockchain development skills or hire developers, plus significant capital for reserves, legal compliance knowledge, and a solid plan to maintain stability and gain user trust.

No, Bitcoin is not a stablecoin because its price fluctuates dramatically with market demand, whereas stablecoins are designed to maintain a steady value.

Article By

Paresh Sagar is the CEO of Excellent Webworld. He firmly believes in using technology to solve challenges. His dedication and attention to detail make him an expert in helping startups in different industries digitalize their businesses globally.